Are cryptocurrencies becoming mainstream now? An outline.

by Dragan Djekov

In order to determine the scope of cryptocurrency investing and the width of blockchain technology adoption, we are going to delve into the newest developments and promises of this fintech world while emphasizing the remaining barriers as of today.

By now, the majority of people have heard a thing or two about Bitcoin and the blockchain, yet there are still some key figures that ought to be considered as to whether cryptocurrencies can be labeled as “mainstream” today.

So, let us start exactly there: What exactly accounts for cryptocurrencies earning the label “mainstream”?

Cryptocurrencies becoming mainstream? The pros and cons

To set the perspective, this article is going to introduce key figures in the development of cryptocurrencies considering a road map of improvements in the fields of market access, consumer behavior and the variety of use cases of blockchain technology.

To determine the success and range of application, we can pinpoint relevant milestones with regard to mainstream adoption.

On the one hand, the fast-paced development resulted in an adoption of the most popular currencies by payment providers for physical goods and everyday purchases, meaning that apart from the emergence of marketplaces like Binance, there are now many more touchpoints with cryptocurrencies in our daily lives than there have ever been before and the trust in DeFi has been continuously growing. Moreover, industry leading providers like Stripe and PayPal are already moving swiftly in terms of adoption.

Another big milestone is the decision of many governments to form policies in favor of cryptocurrencies and the blockchain. More than 60 central banks are currently exploring or actively developing CBDCs, according to PwC. For example, the government of China, the European Central Bank, as well as the US Federal Reserve are currently amongst the major players that are working on projects that are expected to bring about significant changes.

What also needs to be mentioned is the blockchain application in security tokens, tokenization processes and smart contracts. This will broaden the horizon and allow for new opportunities, such as the possible establishment of secondary markets for security token trading.

While at this very moment we can agree that increase of use cases is driving interest and application, other relevant aspects like market access and compliance, as well as government induced regulations need to be considered as potential obstacles to mainstream adoption and usage of cryptocurrencies and blockchain technology.

Blockchain’s blooming pop-culture power vs. the process of mainstream adoption and compliance

In the following part we are going to take a look at the current status of existing regulations and compliance, as well as point out the obstacles in terms of mainstream-adoption and application of blockchain technology.

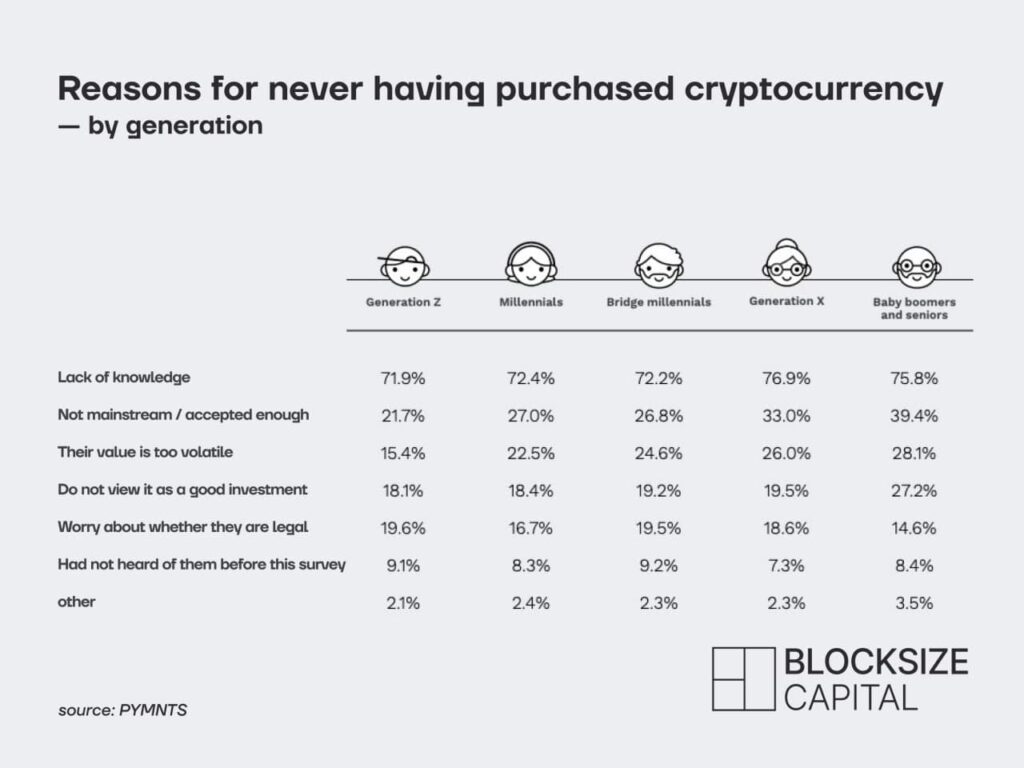

To begin with some of the main obstacles, it is helpful to take on the perspective of an average individual. As stated in a recent survey by PYMNT in cooperation with bitpay: “Interest in cryptocurrency is gaining traction among consumers who would like to use it for purchases.” On the downside, the main reason for not owning any value in cryptocurrency is pinpointed as a lack of knowledge about DeFi and blockchain technology.

According to the survey 75% of non owners mentioned a lack of knowledge, while 33,3% argued with the absence of mainstream adoption/ merchant acceptance and 25,2% substantiated their decision against purchases of cryptocurrencies with the value being too volatile.

Right now, the average person might still feel slightly intimidated by the processes behind trading or investing in cryptocurrencies, but since many companies and structures are making an effort to pave the way into more ease and understanding, the existence of this obstacle in terms of mainstream adoption will fade away in time.

Trust is good, compliance is better (for everyone involved)

In light of the rising value of cryptocurrency assets and expanding userbases on exchanges such as Coinbase and Diginex, cooperation with regulatory bodies and compliance with various guidelines in different markets seems to be one of the overriding obstacles towards the way of merchant acceptance and mainstream adoption.

For example, even though Binance is currently distancing itself from trading of derivatives because of compliance guidelines – this is going to result in “more market access and acceptance, not less” (Changpeng Zhao, Binance CEO), as the market volatility is decreasing thanks to stability granted by meeting compliance regulations, transparency and increased adoption of cryptocurrencies as a whole.

Despite the process of compliance demanding a commitment of transparency and cooperation with regulatory bodies from exchanges and platforms, the resulting increase of market access and trust is ultimately going to benefit mainstream adoption. Still, there’s no short way around the process of enabling every individual in a community to become educated and have access to trading and investing in cryptocurrencies. Good things usually take time.

Our conclusion

The adoption of cryptocurrencies is progressing at a rapid pace. As of today, the lack of regulations, as well as insufficient communication and trust regarding nonowners of cryptocurrencies remain as the biggest obstacle towards mainstream adoption, taking into account that blockchain technology itself significantly improved community-building and its awareness is carried by a growing cultural movement.

From a financial perspective on blockchain technology, investment strategies nowadays are becoming unthinkable without at least the addition of digital assets.

In order for cryptocurrencies to be labeled as “mainstream”, when it comes to merchant and consumer acceptance, as well as governmental and institutional trust, there are certain requirements that need to be fulfilled. Education, compliance and blockchain technology at a mainstream-scale are most frequently being mentioned in the current debate with very promising developments for the future at hand.

Today we can speak about blockchain technology being “business-ready” when it comes to performance and functionality, but to set the perspective on future developments, the term “blockchain” is now also being perceived in connection with various opportunities to dismantle old structures, while also enabling us to see how blockchain technology can improve our modern day society.

Smart investment strategies and a balanced knowledge transfer are going to fuel the motor of an essential and rapid shift towards the crypto market today, and even more so once we have reached a certain point in time where every individual is better informed and has direct access to blockchain technology.

Until we’ve reached the mainstream status of blockchain and cryptocurrency adoption, you can position yourself strategically and become ready for the fintech developments of the future. By partnering up with Blocksize Capital, you will have access to a fully compliant, reliable, and secure infrastructure to analyze, trade and manage Digital Assets. Get in touch with us now and embrace the new digital capital markets with confidence.