Bitcoin vs. Gold – What Is The Better Inflation Hedge?

by Dragan Djekov

Before we start talking about the solutions, we have to address the problem and the reason for this article.

“By a continuing process of inflation, the government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” – John Maynard Keynes

Now, explaining in detail, what inflation is, what kind of different forms of inflation exist, what are impacts of it, and when does inflation turn into hyperinflation, would go beyond the scope of this article and we will not go down this rabbit hole.

We keep it simple and call a spade a spade. An increase in the supply of money is the root of inflation!

Money supply can be increased by the monetary authorities – for us Europeans the European Central Bank – either by printing and giving away more money to the individuals, by legally devaluing (reducing the value of) the legal tender currency, more (most commonly) by loaning new money into existence as reserve account credits through the banking system by purchasing government bonds from banks on the secondary market.

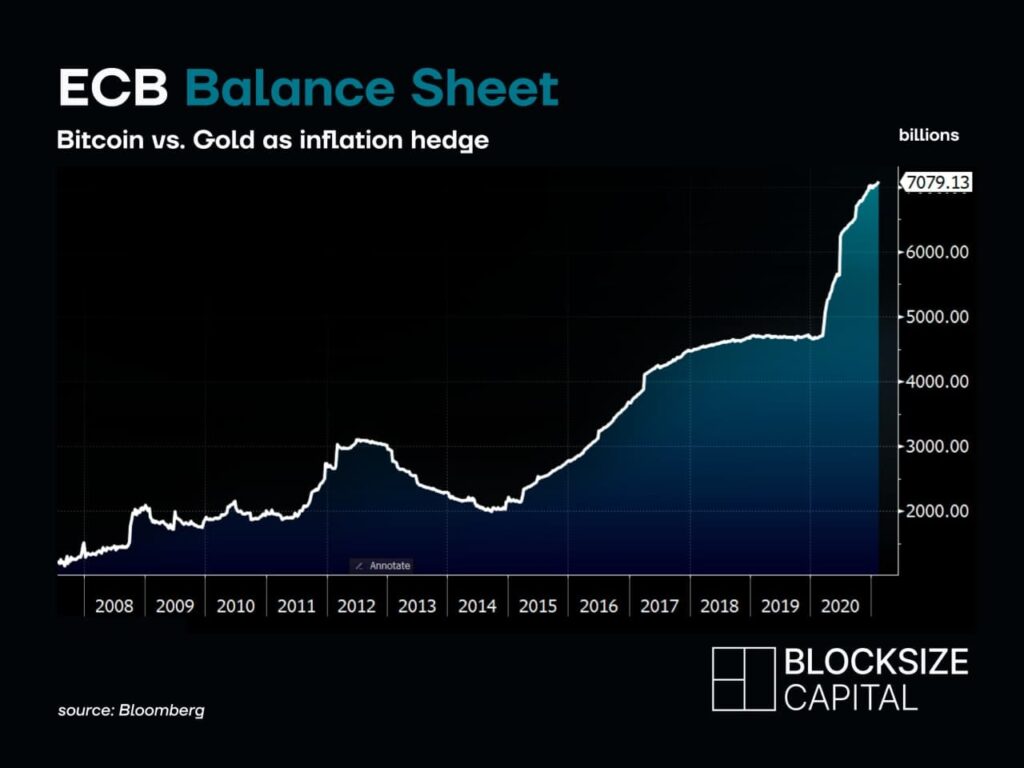

And this supply of fresh printed Euros by the ECB can be seen in the graph above. We believe, that nobody needs to be an expert to see the enormous risk and the possible impact this huge money supply will have in the near future.

Just to put things into perspective! You might remember the year 2008 and the impact it had on Europe. Now check the graph again and compare the actions of the ECB from 13 years ago and what has been done since the beginning of 2020.

By the way, we used the chart of the ECB, due to the fact that we are based within the Eurozone, but the charts of the other central banks worldwide (Fed, BOE, BOJ, etc.) look pretty much the same.

A Euro today will not buy the same value of goods in ten years.

Inflation measures the average price level of a basket of goods and services in an economy; it refers to the increases in prices over a specified period of time.

As a result of inflation, a specific amount of currency will be able to buy less than before.

Therefore, it is important to find the right strategies and investments to hedge against inflation.

Keeping inflation-hedged asset classes on your watch list—and then striking when you see inflation begin to take shape in a real, organic growth economy—can help your portfolio thrive when inflation hits.

Ever since gold has been the most popular hedge against inflation of fiat, besides commodities, 60/40 Stock/Bond-portfolios, real estate, and S&P500 to name the most common.

Since we mentioned the year 2008 already, this year had more to offer than just a dramatic impact on the global financial markets. 2008 was as well the birth year of a possible solution. Bitcoin, build on the blockchain offers a secure system, which has the main purpose to solve the inflationary monetary system of fiat currencies.

Bitcoin, as well called the “digital gold” has not been considered an asset for hedging against inflation, at least not by the majority of investors and the wider public.

We believe it is about time to compare both assets as inflation hedges and take a closer look at the pros and cons of the shiny metal and the coded blocks.

1. Reputation

Gold’s established system for trading, weighing, and tracking is pristine due to the long history of the asset on the markets. Compared to the just 12 years of existence of Bitcoin’s blockchain, it is safe to say, that Gold has a higher reputation with most conservative investors. However, this is changing every day since Bitcoin’s system is developing rapidly with more and more use-cases finding adoption.

2. Safety

With the right measurements in place, it is hard to pass off fake gold or to otherwise corrupt the metal. However, there are many different marketplaces offering cheap metal which just looks like gold. Official certification and a test by a trustable goldsmith are always recommended. Bitcoin is also difficult to corrupt, thanks to its encrypted, decentralized system and complicated algorithms. A bitcoin can not be faked, due to blockchain technology which requires approval from thousands of individual computers all over the world.

3. Storage and transportation

Gold bars are heavy and hard to move around. After all, this fact actually led to the use of paper money which was pegged with gold at the beginning. If the right infrastructure is in place, it is very hard to steal it. Heavy vaults with an up-to-date security system are required and the more gold has to be stored, the bigger the vault has to be. This differs big time over storing Bitcoin since the storage is made using codes, written on the blockchain. All that has to be taken care of, is access to the wallet, which can be saved digitally on a memory card or taken fully offline by writing the wallet code down. Both assets can either be held safe by the individual or can be stored with a custodian. If gold has to be moved, especially bigger amounts, it becomes a risky operation that includes heavy security measures and therefore costs a lot of money. Bitcoin instead, can be transferred as easily as sending an Email.

4. Rarity

Both gold and bitcoin are rare resources. The halving of Bitcoin’s mining reward ensures that all 21 million Bitcoin will be out in circulation by the year 2140. While we know that there is only 21 million bitcoin that exist, it is unknown when all the world’s gold will be mined from the earth. There is also speculation that gold can be mined from asteroids, and there are even some companies looking to do this in the future. Therefore it seems that bitcoin wins the race in case of scarcity.

5. Baseline Value

Gold has historically been used in many applications, from luxury items like jewelry to specialized applications in dentistry, electronics, and more. In addition to ushering in a new focus on blockchain technology, bitcoin itself has tremendous baseline value as well. Billions of people around the world lack access to banking infrastructure and traditional means of finance like credit. With bitcoin, these individuals can send value across the globe for close to no fee. Bitcoin’s true potential as a means of banking for those without access to traditional banks has perhaps yet to be fully developed.

6. Liquidity

Both gold and bitcoin have very liquid markets where fiat money can be exchanged for them. Though, gold’s market cap of $11 trillion is outpacing bitcoin’s market cap with currently $650 Billion.

7. Volatility

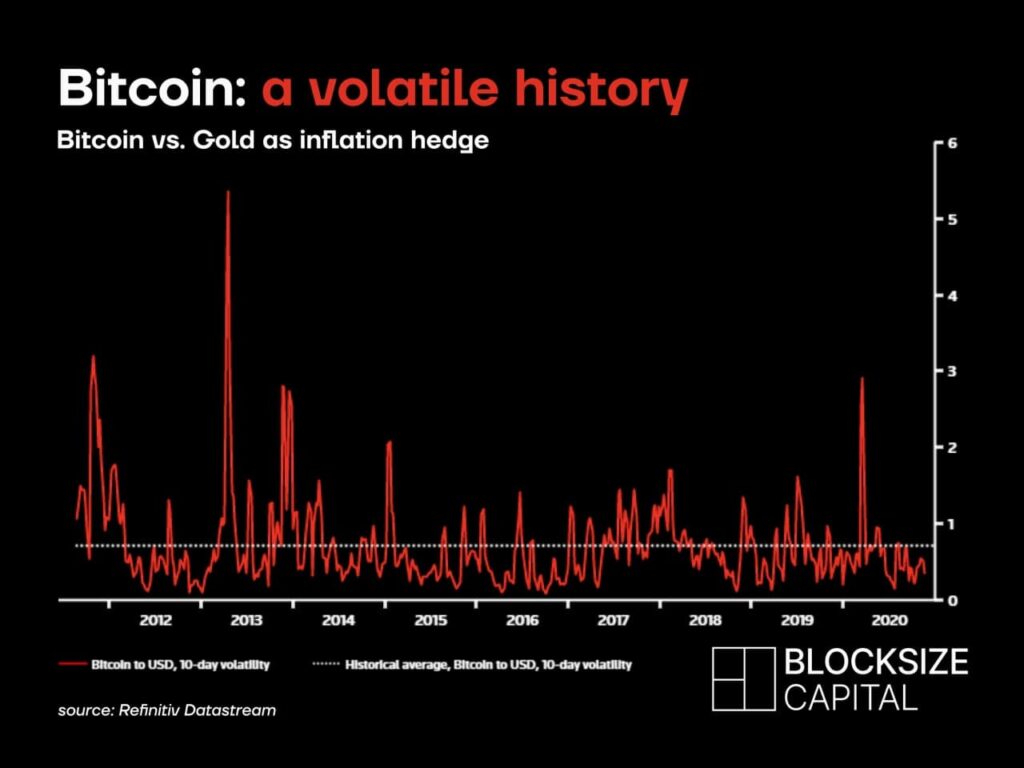

One major concern for investors looking toward bitcoin as a safe haven asset is its volatility. One need look only at the graph above, showing the high volatility of this asset. Besides that, bitcoin has historically proven itself to be subject to market whims and news. Particularly since many famous people with a high influence in social media have entered the markets, their input causes the price of bitcoin to go upward or downward quickly. This volatility is not inherent to gold. Historically, gold is about as volatile in price as stocks, making it perhaps a safer asset. According to a February WGC report, Bitcoin has been four and half times more volatile than gold over the past two years.

8. ROI

The main purpose of an inflation hedge is to secure the purchasing power of money. But ideally, an investment into an asset comes along with a return. And in this case, bitcoin is by far the best performing asset since its existence. The facts are mindblowing if you break it down to what happened over the last 12 years. If you would have invested just $1 in BTC on the 6th of October 2009 when Bitcoin first had a market price, your investment would be now worth over $45 Million. The same $1 invested in gold in October 2009 is now worth $1.74.

Conclusion

For hundreds of years, gold has dominated the safe-haven asset arena, while bitcoin was launched just over a decade ago and has only achieved widespread recognition in the last few years. Because of this big difference in existence, it is not unequivocally possible to crown a winner of both as the better inflation hedge.

Both assets, experts say, are often seen as ways to diversify a portfolio or as a hedge against fiat currency inflation brought about by what some observers see as unsustainable fiscal and monetary policies.

To decide, which is the preferred asset to hedge against inflation, to secure wealth while Euro, Dollar & Co. losing their purchasing power, is up to each individual. If you prefer to have a shiny asset you can touch and feel, that has a long history in humankind, gold might be your choice. You might not see a triple-digit return of investment but you hold an asset that proofed to be a legit inflation hedge during times of inflation in the past. If on the other hand, you trust in the code of the blockchain, you prefer to have an asset that can be transferred without including third parties and which had eye-watering returns in the past 11 years of its existence, bitcoin might be the inflation hedge of your choice.

After all, the best choice is usually diversity and that applies as well for an investment portfolio to hedge against the devaluation of fiat currencies. So why not hold both.

If you are ready to include bitcoin and other cryptocurrencies in your investment portfolio, Blocksize Capital is the right partner for you. We offer dedicated software-as-a-service applications for institutions. For example, Blocksize Matrix™ is a comprehensive suite of tools for institutional asset managers. In addition to trading and the administration of crypto-assets, it also provides the ability to track and aggregate portfolios.

Let’s get in contact before the next inflation hits.