Crypto Space Impacted by Senate’s $550 bn Infrastructure Bill on Tax and Inflation

by Dragan Djekov

The days of David (The Underestimated Decentralized Cryptocurrency Space) and Goliath (The Governing Centralized Entities) are far from over. The two continue to contend and face off against one another in an ebb and flow of rigid rules and overlooked loopholes within this new hybrid era of financial-technological favorableness.

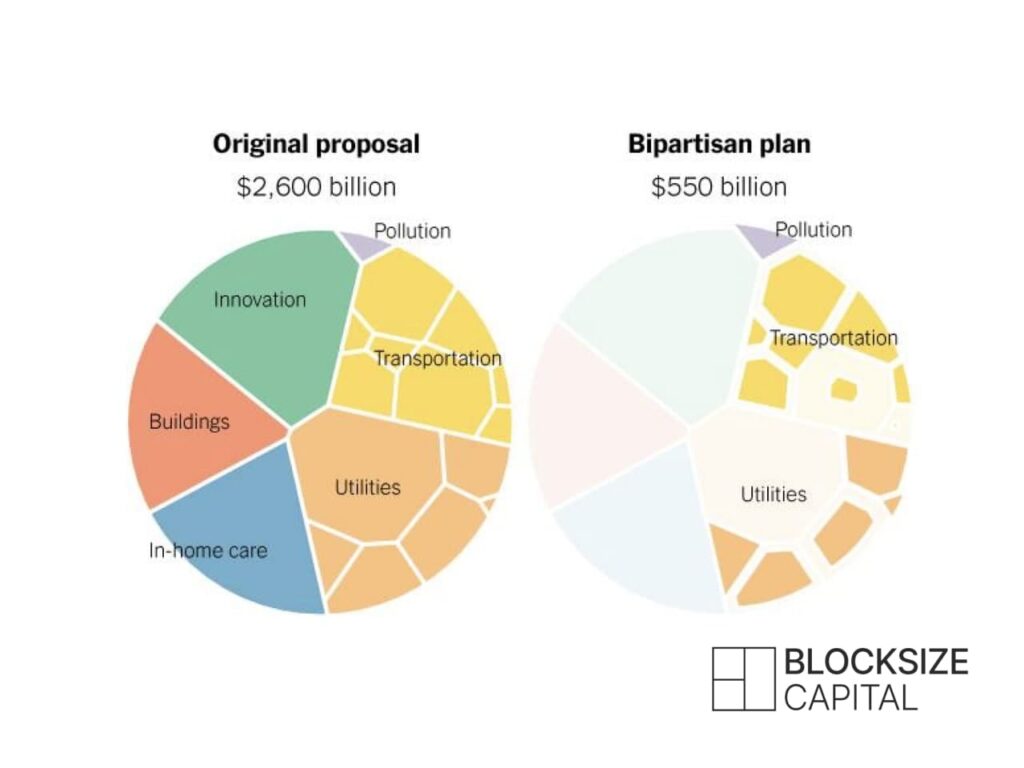

The regulatory bodies have passed a massive infrastructure bill in the Senate that contains Crypto Tax Reporting Rules that will indefinitely influence and affect the use case and application of the digital assets space. This is one of the biggest notions of US President Joe Biden’s economic reform agenda following his newly inaugurated position in the White House, which also represents the largest flow of federal financing on U.S. public works since multiple decades. The new legislation would then be handled by the House of Democrats for further voting after requested priorities are addressed by the Senate.

The bill, which was passed on a bipartisan basis on Tuesday 10th, August 2021, had a vote of 69 to 30 inside the US Senate. Unfortunately, what did not pass was a certain crypto related Amendment in the bill regarding pulling back some of the tedious legislation that is fixated on players and involved parties in the crypto ecosystem for extensive tax reporting.

“…just to add a little bit of the texture beneath the surface on what was happening in the Senate, you effectively had 98 senators, Democrats and Republicans and the Treasury Department agree effectively that the legislation as it was written that people were so concerned about in the crypto space, it seemed to imply, effectively that software developers, that stakers, that miners, basically that everyone who played Any Role in the Crypto Space was going to be subject to the kinds of taxation disclosure requirements that would be appropriate for an exchange, someplace like Coinbase or a Kraken.” – Ash Bennington, Senior Crypto Editor at Real Vision

How detrimental would these new taxation laws in this bill be to those within the Crypto Community?

The results would be absolutely devastating on a wide scale basis. On a microscopic level, it would be especially crippling to the smaller players, dabblers, enthusiasts, those who are just trying to make ends meet day trading, or those who are exploring new self-supplying, self-sustaining alternatives away from the standardized matrixed options, such as setting aside a long term investment akin to a contemporary retirement plan within a diversified portfolio.

These sudden red flags would be detrimental in halting or hindering progression and development in the crypto world within the United States’ 50 territories. Any crypto startup company on the cusp and edge of world changing innovations, with next level application, would be shaken to their technological cores, blockaded from refining their newly discovered inventions, and utterly decimated into compliant debris at the subjugation and subjection to such formidable statutes.

Lawyer, Jake Chervinsky, who specializes in Crypto-related securities litigation, has made it known that this bill would be detrimental to existing businesses as well who would not be able to comply. Their only choices would be to close down for good or to be moved out internationally because the bill would threaten and coerce them to report statistics and data to the IRS that they can’t access or possess.

The governance of crypto is indeed a pinned focal point for the SEC and factions of the highest political houses of authority and legislation, in order for the systemic regulations to impose their constructs and limitations on what is allowed, what is not, and what is beneficial as a tax opportunity to extend their reach beyond their necessary means.

“…amendment put forward by Senators Warner, Portman, and Sinema strikes the right balance and makes an important step forward in promoting tax compliance.” – The White House

The White House put forth a seemingly spontaneous stance on favoring adherence to tax laws, which is promoted within the broad and vaguely written sections of the bipartisan bill regarding brokers of digital assets and crypto trading gains. Arguments have arisen amongst Crypto supporters and advocates who express that the terminology and phrasing of the original legislative language is not specific or detailed enough, making all involved in the Crypto world vulnerable and subject to these new, imposing taxation regulations.

Amendments have now been pushed for and discussed between the two opposing senator camps, to refocus and adjust the extent of these stricter tax rules in question on cryptocurrency transactions. Such adjustments would further clarify the parameters of how taxation is applied and enforced in this financial area with aims to reduce tax evasion amongst all involved, including profiters high and low.

“I was going to say these pullbacks are de minimis in terms of Ethereum that just rallied 75% off of its $1700 low, it rallied straight through 3k, straight through its resistance levels and has essentially gone parabolic. That was a really great unpacking of the SEC, and the more technical rules that are probably driving the moves that we’re seeing right now… That’s just the price action that traders like us notice and say, okay, if it’s going to survive that beating, it’s probably got a lot more life in it to go.” – Tony Greer of TG Macro

Despite the passing of the infrastructure bill, as if almost out of sheer symbolic rebellion, the Crypto Space defies the approaching central grip hold that is trying to smother its lucrative growth, financial opportunities, and its players with clear, visible weekly gains. BTC, Ethereum, and other power position tokens are pushing beyond their moving average resistance levels, breaking out of their low confines to new highs, showing that against all odds, in the face of authoritative control, the value of crypto continues to break preconceived notions and assumptions of its maximum potential influence on the financial markets.

What is the correlation and connection between Crypto and the Infrastructure Bill anyway?

In layman’s terms, because the bill is so expensive, it has included a number of financial incentives to fund and create an inflow of new money for the government to balance out the high end costs of other sections of the bill. Therefore, Crypto taxation would bring in tens of billions of dollars to offset those due amounts.

Crypto is like an innocent bystander, which has been targeted, stalked, hunted, and victimized in the crossfire, and then thrown to the tax wolves for fodder, feeding the never ending abyss of government required revenue.

Are there any optimistic inclinations to this whole situation?

Amidst all the uncertainty of the legal future for Crypto within the US walls, a possible positive outcome would be that even if the market dropped due to Americans sold off massive amounts of holdings and portfolios, needing to heed to the new regulations, then the lower price adjustments would be an advantageous opportunity that would welcome and invite newcomers, young generation enthusiasts, curious old-money investors, and serious prospects internationally into the Crypto Space.

With Blocksize Capital – you will always have the right, trustworthy partner for a trading solution, – which gives you an-easy-and-reliable access to an infrastructure for all your investment needs. Our clients use our Digital Assets Prime-Brokerage, which we offer in partnership with our regulated banking partners in Germany.