Bitcoin – the scarce newcomer on companies balance sheets

by Jacqueline Winter

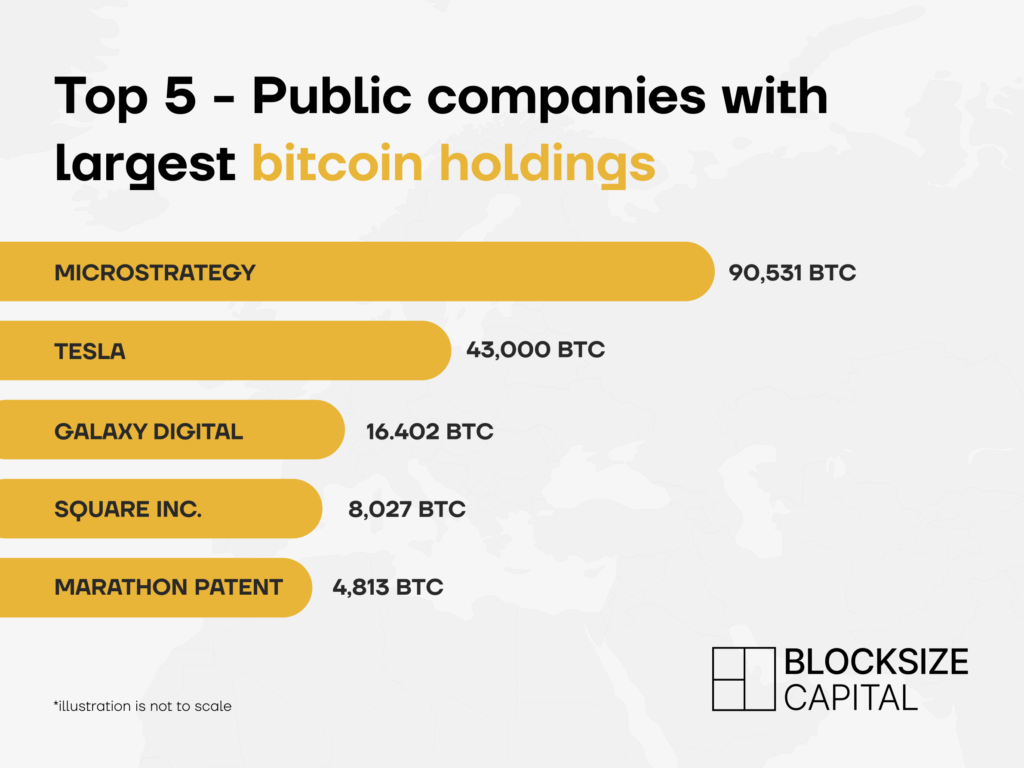

Companies like Tesla, Square, and MicroStrategy have changed their balance sheets by shifting cash into bitcoin and other cryptocurrencies.

Smart finance or risky business?

The Balance sheet. Every bigger and especially public company has to have one. A financial statement reporting the balance of a company’s assets, hence what it owns compared to its liabilities – what it owes, and shareholders’ equity, the amount invested by them, at the time of publication.

The list of currently recognized assets includes cash & cash equivalents, marketable securities, accounts receivable, inventory, prepaid expenses, long-term investments, and fixed and intangible assets.

Cryptocurrencies, like bitcoin, however, are not (yet?) acknowledged assets of a balance sheet but have made it onto some already.

US-based electric vehicle and clean energy company Tesla, Inc. has invested $1.5 billion of its companies cash in bitcoin, which represents about 8% of their cash holdings of $19.4 billion at the end of 2020.

Square, Inc., a financial services and digital payments company based in San Francisco, with a revenue of $9.49 billion in 2020, owns 8,027 bitcoins in total, about 5% of their cash and worth around $438 million based on the current BTC price.

As of February 24, 2021, MicroStrategy, Inc. holds an aggregate of approximately 90,531 bitcoins, acquired at an aggregate purchase price of approximately $2.171 billion. Their core business is providing BI and mobile software as well as cloud-based services.These three companies have one thing in common. CEO’s known as cryptocurrency advocates, addressing their support for bitcoin and Co publicly.

But decisions over investments and the use of cash within a company, are made by a wider board of executives. So what are their motives to invest in cryptocurrencies like bitcoin and might other companies follow and adopt this strategy?

Why Tesla?

The company is known for its disruptive approach to change established things in life, like building electric-powered family sedans accelerating faster than most fossil-powered sports cars. Without a doubt, the bitcoin investment can be seen as yet another “public stunt” to change the established way of handling company cash.

However, there seems to be more behind, since just a few days after the official announcement of the bitcoin purchase, Tesla started to accept bitcoin as a payment for their cars in the US. Furthermore, the company stated that all bitcoins from product sales will remain as bitcoins on the company balance and will not be exchanged into U.S. dollars.

Tesla’s $1.5 billion investment in bitcoin could also be a simple hedge against the hegemony of the U.S. dollar as the world’s reserve currency since World War II.

In its statement filed with its regulator the Securities and Exchange Commission, Tesla made it clear that it sees bitcoin as a chance to diversify its cash and cash-equivalent holdings. Does it work? Well, Tesla made the test!

“…Tesla sold 10% of its holdings essentially to prove liquidity of Bitcoin as an alternative to holding cash on balance sheet.”

– Elon Musk, tweeted on April 27, 2021.

Legal adjustments had to be made upfront and Tesla wrote, “We updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity.” and as well acknowledges the risk as the price of bitcoin could slump, stating: “If we hold digital assets and their values decrease relative to our purchase prices, our financial condition may be harmed,”

Why Square?

The company offers merchant services as well as a mobile payment platform and has two key products, it’s Cash App and Point-of-Sales system.

Since the beginning of 2017, the company’s Cash App allows merchants to use bitcoin in the technology.

“We feel that bitcoin is aligned with our purpose, which is economic empowerment. Economic empowerment is about bringing access to financial tools more broadly, including to people who haven’t had it before. We think bitcoin is a way that could enable that for the future.”

– Amrita Ahuja, CFO Square, Inc.

The current success and positive market response seem to underline that Square is offering a service that has more and more demand.

Square’s Cash App has recorded 36 million users and the platform saw an increased surge in first-time bitcoin buyers since January 2021.

“We had 3 million people transact in bitcoin through Cash App in 2020 and 1 million who were new to bitcoin in January [2021],” said Square’s CFO Amrita Ahuja in an interview on CNBC.

Why MicroStrategy?

MicroStrategy is the largest independent publicly traded business intelligence company that provides modern analytics on an open, comprehensive enterprise platform that is used by many brands in the Fortune Global 500.

Besides that, it is one of the top-ranked companies which has adopted bitcoin as its primary reserve asset.

“We believe our bitcoin strategy, including our bitcoin holdings and related activities in support of the bitcoin network, is complementary to our software business, by enhancing awareness of our brand and providing opportunities to secure new customers.”

– Phong Le, President & CFO

The company reported $482 million in revenue for 2020 with a steady business but expenses going down due to the pandemic, which resulted in piling up cash reserves.

Unlike other CEOs who typically don’t talk about personal investments, Michael Saylor made it clear and public how much bitcoin he personally owns.

He tweeted on October 28, 2020 – “Some have asked how much #BTC I own. I personally #hodl 17,732 BTC which I bought at $9,882 each on average. I informed MicroStrategy of these holdings before the company decided to buy #bitcoin for itself.”

Since August 2020, MicroStrategy is on a buying spree of bitcoin and it seems likely that they will continue with it.

“The Company remains focused on our two corporate strategies of growing our enterprise analytics software business and acquiring and holding bitcoin,”

– Michael Saylor, CEO

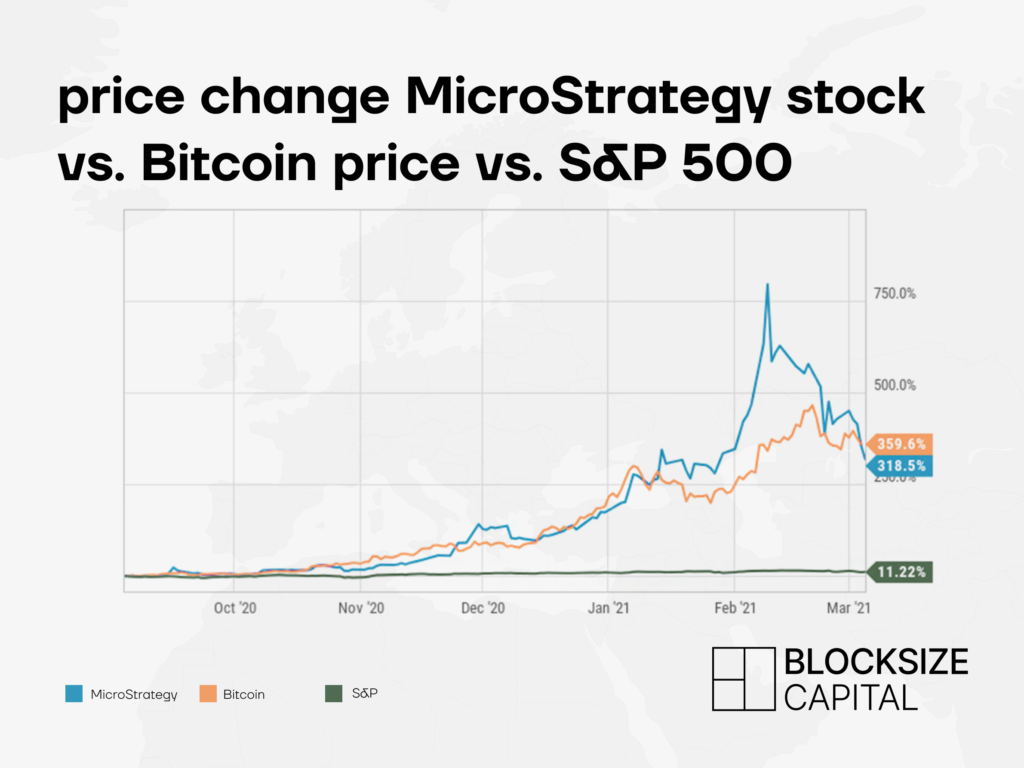

This strategy seems to have a positive impact on the stock market as well since the company’s stock has soared in response and six-folded within half a year.

Conclusion

The reasons for companies to invest in bitcoin and other cryptocurrencies can vary, but it seems that the digital asset has claimed its spot on the balance sheet.

Either it opens new markets, underlines the product technology, or simply is seen as a hedge against the devaluation of fiat currency, it is adapting to the current situation and opens up new possibilities. Yes, it is not without risk and has to be seen as yet another way of investing cash, which has to be calculated and evaluated in any way. As of now, bitcoin is seen as a volatile asset that is prone to sharp price volatility some corporate finance professionals see bitcoin and other cryptocurrencies as an unnecessary addition of risk to the balance sheet.

But in its structure, with a maximum supply of 21 million, bitcoin is a very scarce asset compared to fiat currencies which can be created as much as a central bank please.

According to an assessment of Glassnode, an analysis firm that tracks blockchain data, approx. 4 million bitcoin are circulating on the market right now and this amount has been getting a little smaller with each passing month over the last year. In comparison, in 2020 alone, the Federal Reserve has printed $9 trillion which represents 22% of all circulating US dollars.

With these figures on the table, every company’s board of directors has to decide for themselves if an investment in bitcoin & Co is a smart move or too risky for their business. With increased recognition of bitcoin’s long-term value and with more institutional investors following the path into cryptocurrencies, the volatility will decrease while the scarcity rises. The main question remains! Who is next?

With our Blocksize Matrix™, a comprehensive suite of tools for institutional asset managers for trading and the administration of crypto-assets, we provide the foundation for a safe step into the new area of cryptocurrencies as an asset within your balance sheet. If you want to know more about it, please request a demo.