Trading Stocks vs. Trading Crypto

by Jacqueline Winter

Digital assets are becoming increasingly popular for investors, asset managers, and traders. You might already be familiar with Forex trading, but how does it differ from cryptocurrency trading? What makes the exchanges different, how does the market behave, and how are the fees and regulations?

In this article, we will look at 8 key differences between traditional stocks trading and cryptocurrency trading:

Assets being traded

The main difference between stocks and crypto trading is the asset that you are trading. In the traditional market, stocks are backed by companies and you own shares of that company when you buy their stocks. They have to adhere to certain regulations and get audited by government agencies before they can even list stocks.

Cryptocurrencies on the other hand can be set up by anyone – they are digital currencies with a subjective value that represents projects and sometimes also actual companies.

Ownership

As mentioned above, you become part-owner of a company when buying stocks on a stock exchange, because each stock represents a share. Depending on how well the company is performing, the value of your shares might go up or down.

When purchasing cryptocurrencies, their value is subjective. The price of certain coins will also go up or down depending on how well the project is doing, but they don’t represent company shares in most cases – unless you bought them through a so-called STO (Security Token Offering) where each token is backed by a company share. Cryptocurrencies can have very different utilities – some are for file storage, some are for smart contracts, some are for exchange fees, some are earned through activity or in games, some are tokenized shares of assets, just to name a few.

Setting up your trading account

Trading with traditional stocks requires much paperwork to get started, as well as finding and hiring a broker, and getting approval to buy and sell. So you need some investment to get started and cover the cost for the broker, as well as enough time to make profits from long-term trades.

If you want to start trading with cryptocurrencies, the process is much quicker: simply sign up on a cryptocurrency exchange platform, verify your account, and start trading. On many exchanges, you can deposit funds through wire transfer or even credit card.

Setting up your account is free, and you can get started with a very low investment.

Market maturity

Stock exchanges have been around for much longer than cryptocurrency exchanges – so naturally, they are more mature. They are backed by governments and have to adhere to regulations and local laws on their activities.

Publicly traded companies also have to make market activity public, including quarterly financial updates and minutes of general meetings. This maturity allows stock exchanges to have high volumes and diversity of trade – but it has also given some traders the opportunity to dominate trading circles. This could provide a disadvantage for smaller investors because the stock market rewards bigger investors with lower fees or commissions on trade.

Cryptocurrency exchanges on the other hand are still quite young, providing a volume and diversity of cryptocurrencies that is far less than that of stock exchanges. However, the market is continuously growing, turning into an asset class that is very attractive for investors and asset managers.

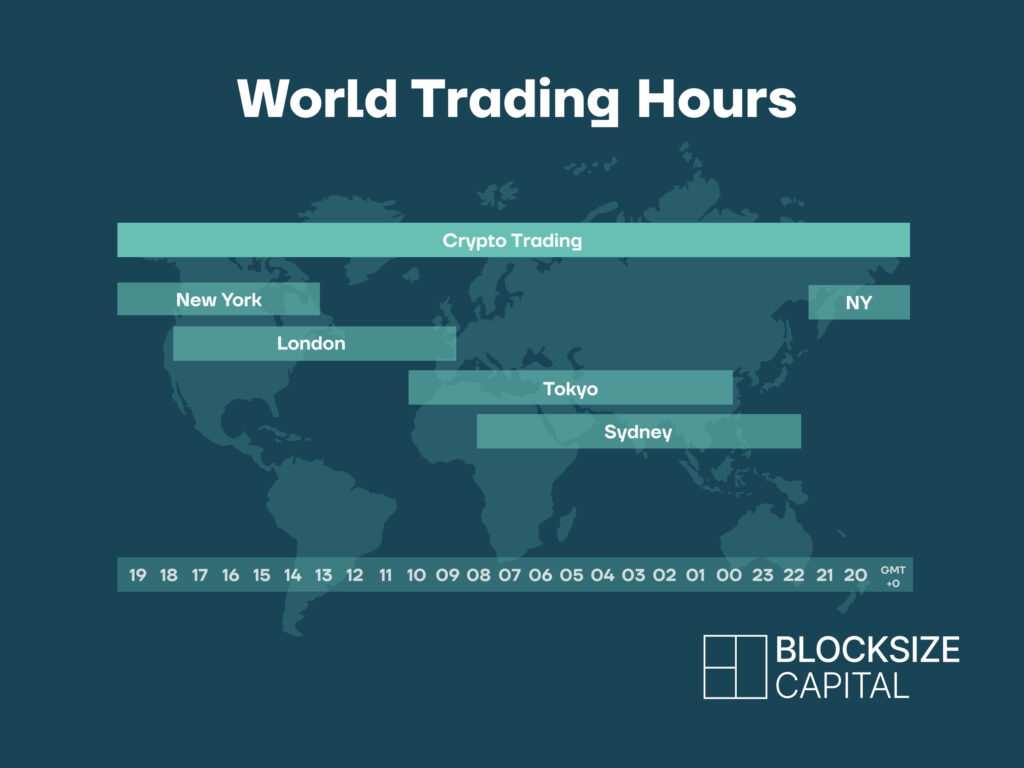

Trading Hours

Most traditional exchanges have trading sessions – meaning that you can only do transactions in certain time periods, for example, 9am to 6pm, with no trading during weekends and official holidays.

So any real-life events that happen in between trading hours have no instant impact on the market – instead, there can be rather large corrections when the market re-opens, making it harder for traders to plan ahead. Most traders prefer not to have any open positions in between trading hours when the market is closed.

Cryptocurrency exchanges on the other hand are available 24/7, regardless of weekends or holidays. This means that the market can instantly react to any event, and you can make profits via news if you are quick enough. But on the other hand, this also means that you often want to be online as much as possible, to minimize the potential of missing opportunities or important news.

Insurance

When you buy stocks from a broker, there is often an insurance in place – in the US for example, the SIPC and FDIC offer up to $500,000 government reimbursement in case your deposits with the brokerage business are lost.

With cryptocurrency trading on the other hand, there is no insurance.

Of all the cryptocurrency exchanges, only a few like Gemini and Coinbase offer some kind of cash insurance. There is no insurance security through SIP because the US has not recognized cryptocurrencies in this way yet. Fees and regulations

Stock exchanges are heavily regulated marketplaces. They have to adhere to many rules and are under constant review by the government, trying to keep the playing field as fair as possible for both traders and investors.

In addition to the rules, there are also fees and associated costs with traversing the stock exchange, which are relatively high. You need a broker which will charge a fee or commission, the bank will also charge you to make payments, and of course, capital gains need to be taxed as well.

Trading on cryptocurrency exchanges includes fewer costs. Transaction costs on the blockchain are minuscule because they only consist of mining fees. Exchanges themselves do have fees for trading and transacting, which can vary depending on which platform you use.

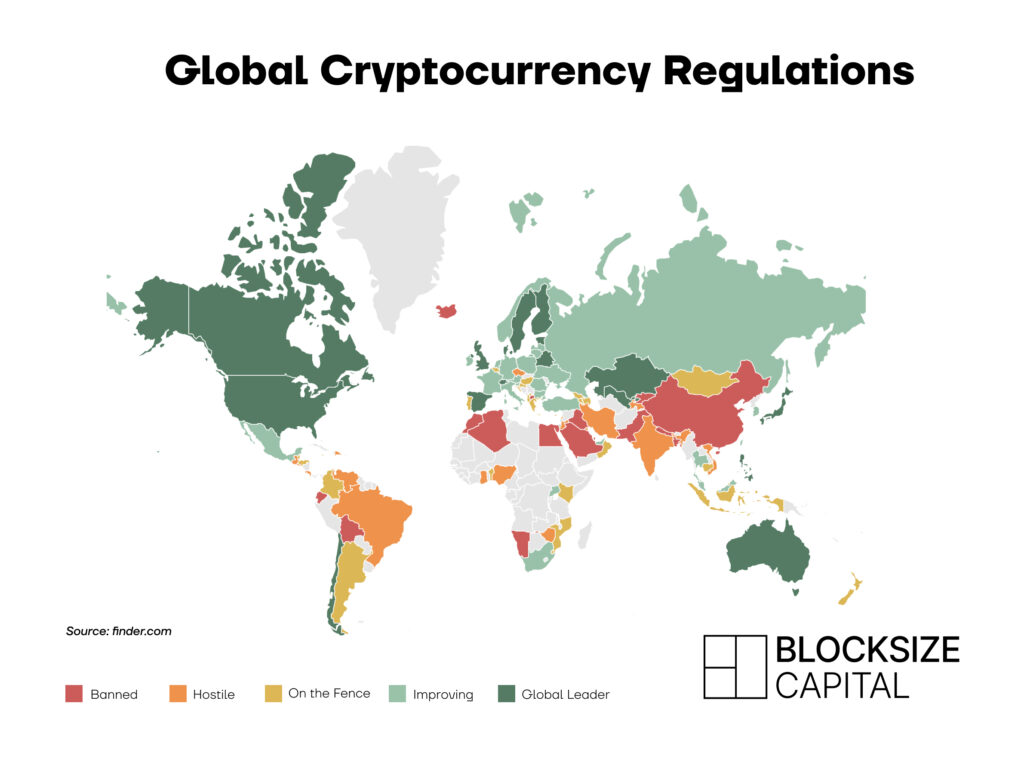

Cryptocurrency exchanges are still mostly unregulated as of today, although many countries are experiencing rapid development in their regulation of digital currencies and trading.

Market volatility

Last but not least, the volatility of the market is one of the biggest differences between traditional trading and cryptocurrency trading.

A lower volatility means that the market, and investment, is more stable – but this also means that you often have to wait longer for a financial reward. This is mostly the case with the stock exchange. The large trade volumes make the stock market more stable and less prone to the movements of big traders. But the connection with governments and corporations everywhere in the world also means that the stock exchange is frequently impacted by geopolitical events.

Cryptocurrency markets have much higher volatility. The market is new and has very pronounced highs and lows, making the cryptocurrency marketplace vulnerable to the trade movements of “whales”. (A whale is a trader who owns a large amount of cryptocurrency) And so, the whole market can be vulnerable to the trade decisions of those that own a large portion of the market. For example, when news broke in January that Elon Musk invested $1.5 billion in bitcoin with his company Tesla, the price of bitcoin jumped 17% to a new record high within hours. A jump like this is rarely seen in the stock market but can happen quite often in the crypto space. The higher volatility of the cryptocurrency market inherits more risk but also holds the potential to make more profits much quicker.

Conclusion

The cryptocurrency market differs from traditional markets in many ways – from ownership to regulation, fees, and volatility. The whole industry still has enormous potential for growth, as payment giants like PayPal, MasterCard, Visa and more are joining the cryptocurrency space. It offers a great opportunity to increase diversity in your or your clients’ portfolio.

Blocksize Capital allows institutional asset managers to take advantage of the benefits of the cryptocurrency market with our comprehensive trading terminal. This institutional-grade suite of tools allows you to trade and manage your crypto assets across multiple connected exchanges, track and aggregate portfolios, and receive sophisticated data sets and aggregated market information through our Quant SDK.